Infographics on Derivatives (& More) @Demonocracy

Monday, May 14, 2012 at 02:31PM

Monday, May 14, 2012 at 02:31PM [NOTE]: Demon•cracy presents some brilliant data visualization on the threat posed to all of us by the global financial giants, like JP Morgan Chase, who are gambling with complex instruments, like derivatives, that could destroy the world economy, are distorting democratic society in brutal, ugly ways, and necessitating horrible policies like austerity and endless war. Below are a couple of sample graphics + texts (on bank exposure due to derivatives), but click HERE to view the informative - and terrifying - facts.

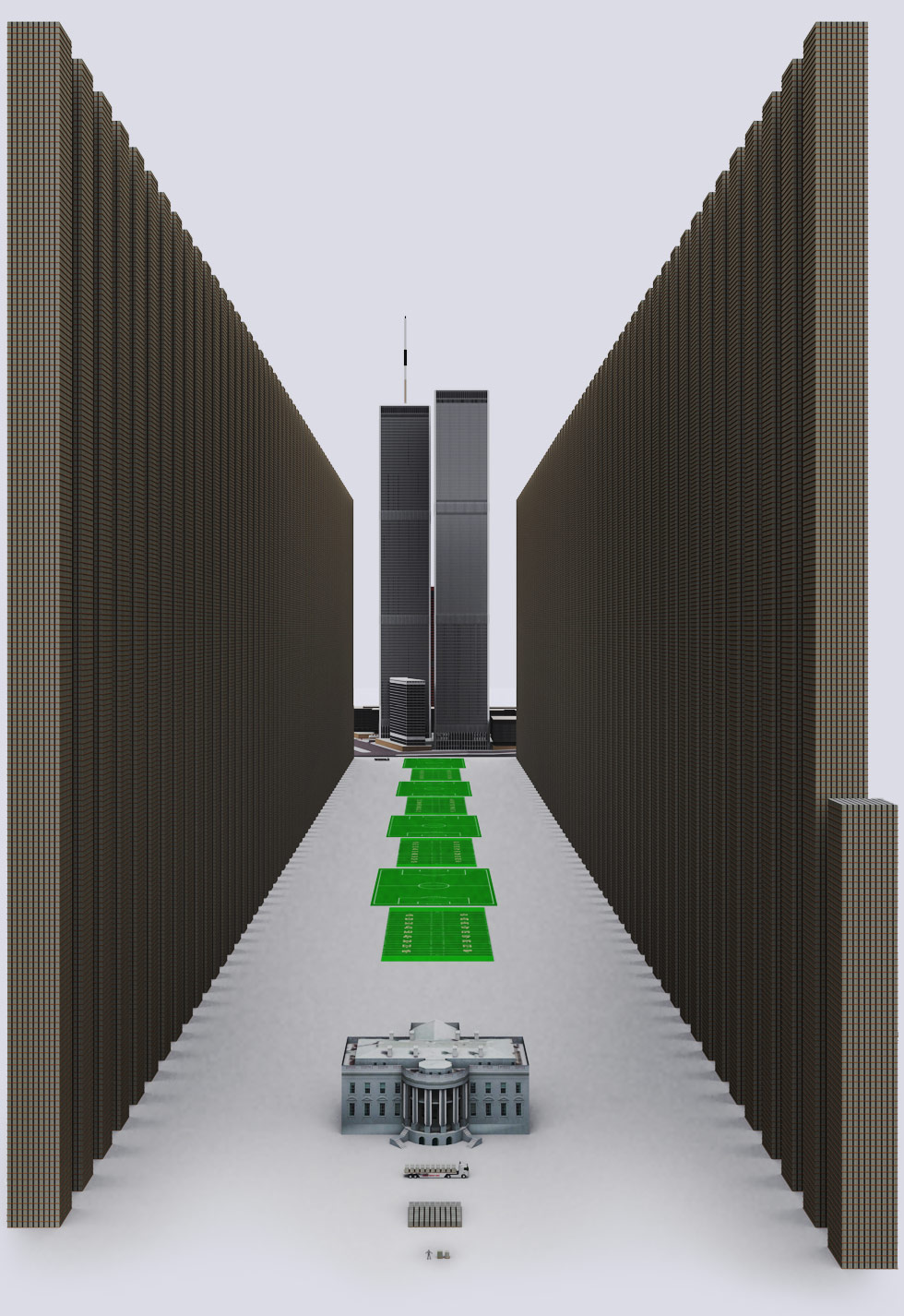

9 Biggest Banks' Derivative Exposure - $228.72 Trillion

|

Note the little man standing in front of white house. The little worm next to last football field is a truck with $2 billion dollars. There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse. Derivative Data Source: ZeroHedge |

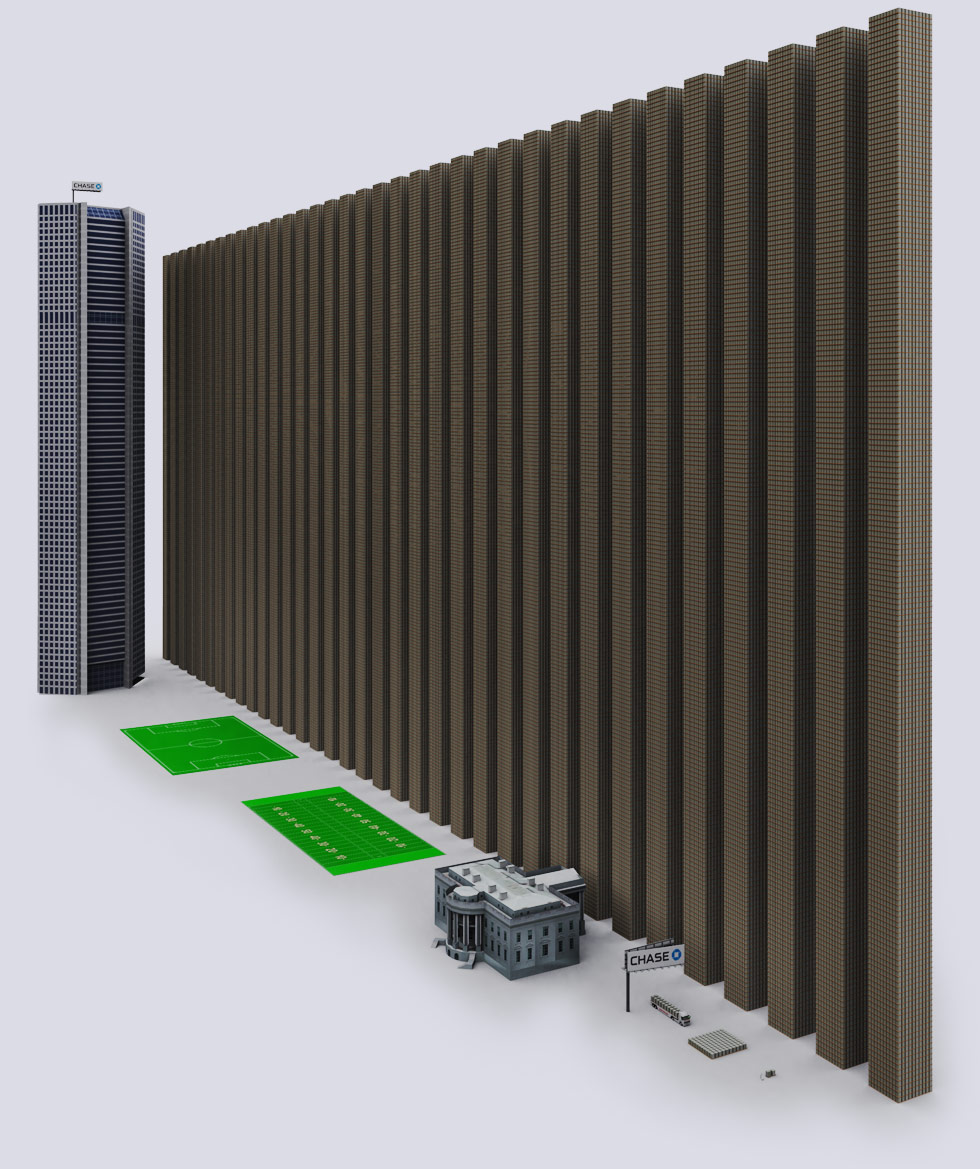

JP MORGAN CHASE

In 2012, JP Morgan (JPM) took a $2 billion loss on "Poorly Executed" Derivative Bets. Click the image above to read about it. |

admin |

admin |  Post a Comment |

Post a Comment |  demonocracy,

demonocracy,  derivatives,

derivatives,  jp morgan chase in

jp morgan chase in  graphics

graphics

Reader Comments